Search for Assistance Programs

Number Of People In Household

The number of people in your household includes anyone living in the home on a full-time basis. This would include adults and children who are not renters. The following people are NOT considered household members:

- Persons who are maintaining their living arrangements temporarily for a reason such as a visit, vacation or education.

- Those in the military, away at college, in a nursing home or a rehabilitation facility, or incarcerated in a correctional facility.

(Exception: If the household has access to a family member’s military income, it does count towards the household income and the individual is counted as a member of the household.)

Yearly Household Income Before Taxes

Maximum yearly household income before taxes includes:

- All sources of income including salaries, wages, child support, SSI, SS and SS Disability, Public Assistance, Workers Compensation, unemployment, pensions, etc.

- Any money earned by a spouse, parent, or any other person 18 years old or over, permanently residing in the home.

- The income of those students who live at home while attending school. However, do not count their income if the student is away at college or other post-secondary education institution.

- Military income, if the household has access to a family member’s military income.

Search Eligibility Programs

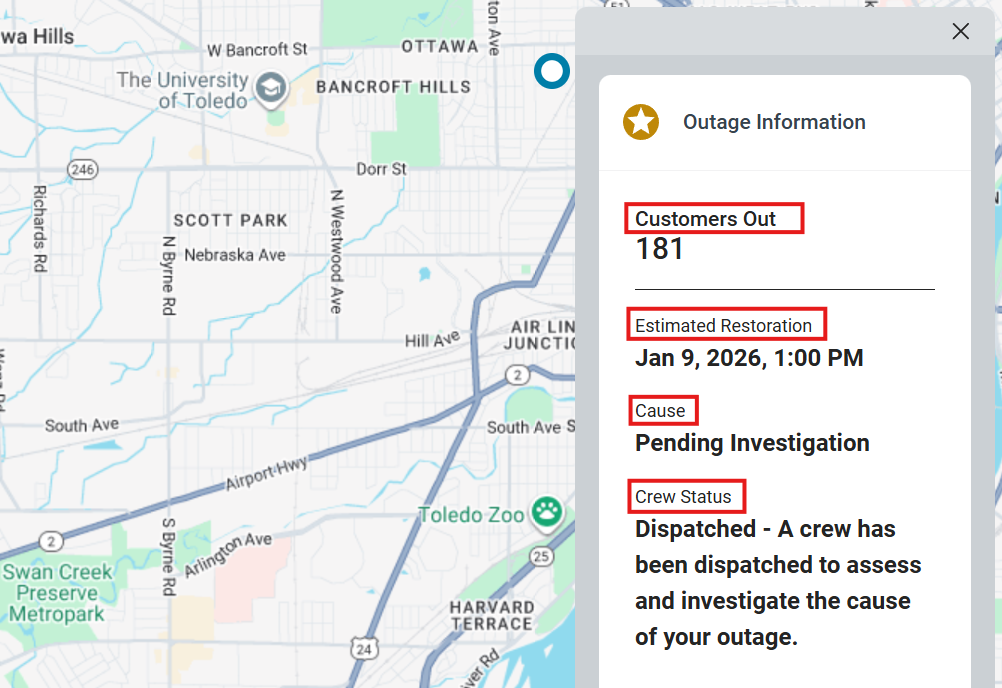

If you are struggling to make ends meet, we have ways to help pay your home electric bill on time—and get the support you need. Use the search tool below to see the assistance programs for which you may be eligible.

To explore which assistance programs might be available to you, select the number of people in your household, yearly income before taxes, state and operating company.*

*This information is for reference purposes only and does not verify eligibility for any program.

Visit the program site for more information or to apply.

-

Payment Assistance Programs

Other Payment Assistance Programs in Your Area

We did not find any programs to fit your search criteria, please see all programs available in your area below.

*By clicking this link you are leaving the FirstEnergy website and entering a website maintained by a third party. They are entirely responsible for the content of their website.

Email Program Results

Enter the email to which you want this program information to be sent.

Email Program Results

Email has been sent.

.jpg)

%20-%20Mobile.jpg)