FirstEnergy Announces Second Quarter 2023 Financial Results

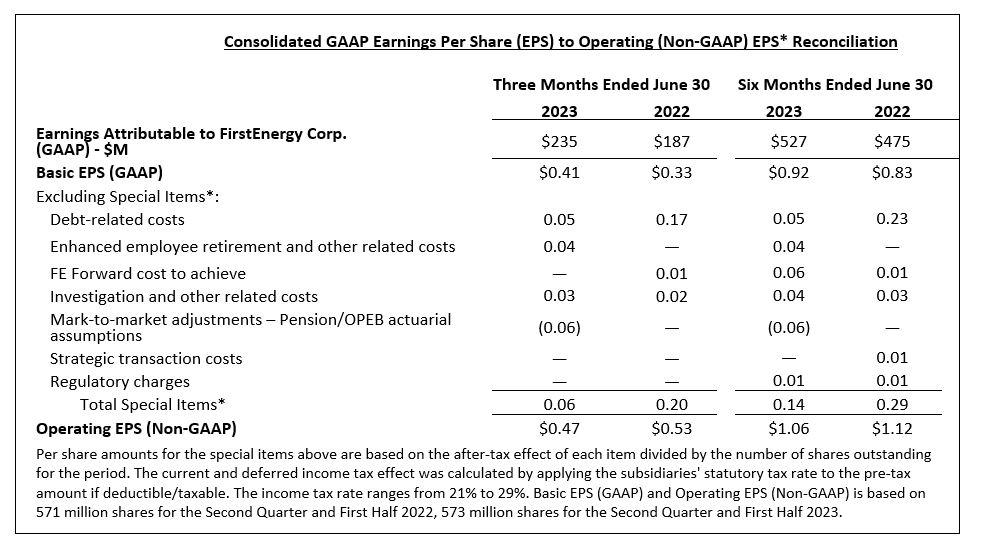

Reports second quarter 2023 GAAP earnings of $0.41 per share and operating (non-GAAP) earnings of $0.47 per share

Affirms 2023 operating guidance and provides outlook for the third quarter

Affirms targeted 6-8% long-term annual operating earnings per share growth rate

Akron, Ohio – FirstEnergy Corp. (NYSE: FE) today reported second quarter 2023 GAAP earnings of $235 million, or $0.41 per basic and diluted share, on revenue of $3.0 billion. In the second quarter of 2022, the company reported GAAP earnings of $187 million, or $0.33 per basic and diluted share of common stock, on revenue of $2.8 billion.

Operating (non-GAAP) earnings* were $0.47 per share in the second quarter of 2023, in the upper end of the company’s guidance range, and were $0.53 per share in the second quarter of 2022. Results for both periods exclude special items listed below.

Continued growth from regulated investments and lower operating expenses were positive earnings drivers in the second quarter of 2023 compared to the same period of 2022. Together, they partially offset higher financing costs and lower pension credits, as well as lower distribution sales that reduced earnings by $0.07 per share compared to the second quarter of 2022, primarily resulting from the impact of mild temperatures.

“FirstEnergy is focused on driving sustainable growth through capital investments that enable the energy transition, improve the reliability and resiliency of the electric grid, and support economic activity and innovation in our communities,” said Brian X. Tierney, president and chief executive officer. “These capital investments, together with the sound strategies that are already underway to strengthen our financial position and enhance our operations, support our goal of becoming a premier electric utility company, and our mission of delivering safe, reliable and affordable power to our customers and communities,” he said.

FirstEnergy reaffirmed its full-year 2023 operating (non-GAAP) earnings guidance range of $2.44 to $2.64 per share based on 574 million shares outstanding. In addition, the company is providing an operating (non-GAAP) earnings guidance range of $455 million to $515 million, or $0.80 to $0.90 per share for the third quarter of 2023, based on 573 million shares outstanding.

The company also affirmed its long-term, 6% to 8% targeted annual operating earnings per share growth rate, which is based off the previous year’s operating earnings guidance midpoint.

Second Quarter Segment Results

In the Regulated Distribution business, higher revenues related to utility investment programs and lower operating expenses compared to the second quarter of 2022 were offset by lower customer usage, primarily related to mild temperatures across the company’s service footprint, as well as lower pension credits and higher interest expense.

Total distribution deliveries decreased 4.9% compared to the second quarter of 2022, primarily due to cooling degree days that were 40% below normal and 48% below last year. Load was down 1.1% on a weather-adjusted basis.

In the Regulated Transmission business, second quarter 2023 operating results primarily benefited from the company’s ongoing Energizing the Future investment program. Rate base increased 8.2%, or more than $700 million, from the second quarter of 2022.

In Corporate/Other, second quarter 2023 operating results were essentially flat compared to the second quarter of 2022. Significant drivers include lower operating expenses and lower interest expense, which were offset primarily by a lower earnings contribution from the company’s legacy investment in Signal Peak.

First Half Results

For the first half of 2023, FirstEnergy reported GAAP earnings of $527 million, or

$0.92 per basic and diluted share, on revenue of $6.2 billion. This compares to GAAP earnings of $475 million, or $0.83 per basic and diluted share, on revenue of $5.8 billion in the first half of 2022. Results for both periods reflect the impact of special items listed below.

Operating (non-GAAP) earnings* for the first half of 2023 were $1.06 per share, compared to $1.12 per share in the first half of 2022.

Results for the first half of 2023 reflect continued growth from the company’s regulated investment strategy and lower operating expenses. These factors partially offset the impact of lower pension credits, as well as lower distribution sales that reduced earnings by $0.18 per share compared to the first half of 2022, primarily resulting from the impact of extremely mild weather.

Through the first six months, heating degree days were 17% below normal and 16% below last year, while cooling degree days were 40% and 47% below normal and last year, respectively.

Non-GAAP financial measures

* Operating earnings (loss) excludes “special items” as described below, and is a non-GAAP financial measure. Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. Management cannot estimate on a forward-looking basis the impact of these items in the context of long-term annual operating EPS growth rate projections because these items, which could be significant, are difficult to predict and may be highly variable. Consequently, the Company is unable to reconcile operating earnings guidance and long-term annual operating EPS growth projections to a GAAP measure without unreasonable effort. Basic (GAAP) EPS and Operating EPS and Basic (GAAP) EPS and Operating EPS for each segment are calculated by dividing Operating earnings (loss), which excludes special items as discussed above, for the periods presented by 571 million shares for the second quarter, first six months, and full year 2022, 573 million shares for the second quarter, first six months and third quarter of 2023, and 574 million shares for full year 2023. Intercompany interest expense/income between Regulated Transmission and Corporate/Other associated with the proceeds from the FET 19.9% minority interest transaction received on May 31, 2022, has been eliminated for segment reporting purposes which is consistent with the methodology used in the fourth quarter and full year 2022 reporting. Management uses non-GAAP financial measures such as Operating earnings (loss), and Operating EPS to evaluate the Company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating EPS by segment to further evaluate the Company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (loss), Operating EPS, and Operating EPS by segment, provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FE has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Investor Materials and Teleconference

FirstEnergy’s Strategic and Financial Highlights presentation is posted on the company’s Investor Information website – www.firstenergycorp.com/ir. It can be accessed through the Second Quarter 2023 Financial Results link.

The company invites investors, customers and other interested parties to listen to a live webcast of its teleconference for financial analysts and view presentation slides at 10:00 a.m. EDT tomorrow. FirstEnergy management will present an overview of the company’s financial results followed by a question-and-answer session. The teleconference and presentation can be accessed on the website by selecting the Second Quarter 2023 Earnings Webcast link. The webcast and presentation will be archived on the website.

FirstEnergy is dedicated to integrity, safety, reliability and operational excellence. Its 10 electric distribution companies form one of the nation's largest investor-owned electric systems, serving customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York. The company's transmission subsidiaries operate approximately 24,000 miles of transmission lines that connect the Midwest and Mid-Atlantic regions. Follow FirstEnergy on Twitter @FirstEnergyCorp or online at www.firstenergycorp.com.

Forward-Looking Statements: This news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cybersecurity, and climate change; the risks associated with cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to accomplish or realize anticipated benefits from our FE Forward initiative and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our transmission and distribution investment plans, executing on our rate filing strategy, controlling costs, greenhouse gas reduction goals, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of additional membership interests of FirstEnergy Transmission, LLC; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including but not limited to those related to climate change; changes in customers’ demand for power, including but not limited to, economic conditions, the impact of climate change or energy efficiency and peak demand reduction mandates; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; future actions taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s filings with the SEC, including, but not limited to, the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise. Forward-looking and other statements regarding our climate strategy, including our greenhouse gas emission reduction goals, are not an indication that these statements are necessarily material to investors or required to be disclosed in our filings with the SEC. In addition, historical, current and forward-looking statements regarding climate matters, including greenhouse gas emissions, may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve and assumptions that are subject to change in the future.

CONTACT: News Media Contact: Tricia Ingraham, (330) 384-5247; Investor Contact: Irene Prezelj, (330) 384-3859